TRADING & INVESTING STRATEGIES

Online Course

REGISTER NOW

LATEST BLOG POSTS (by Deepak Mohoni)

-

For greater trading profits, use trailing stops, not targets

Day-traders incur huge opportunity losses by using targets instead of trailing stops

-

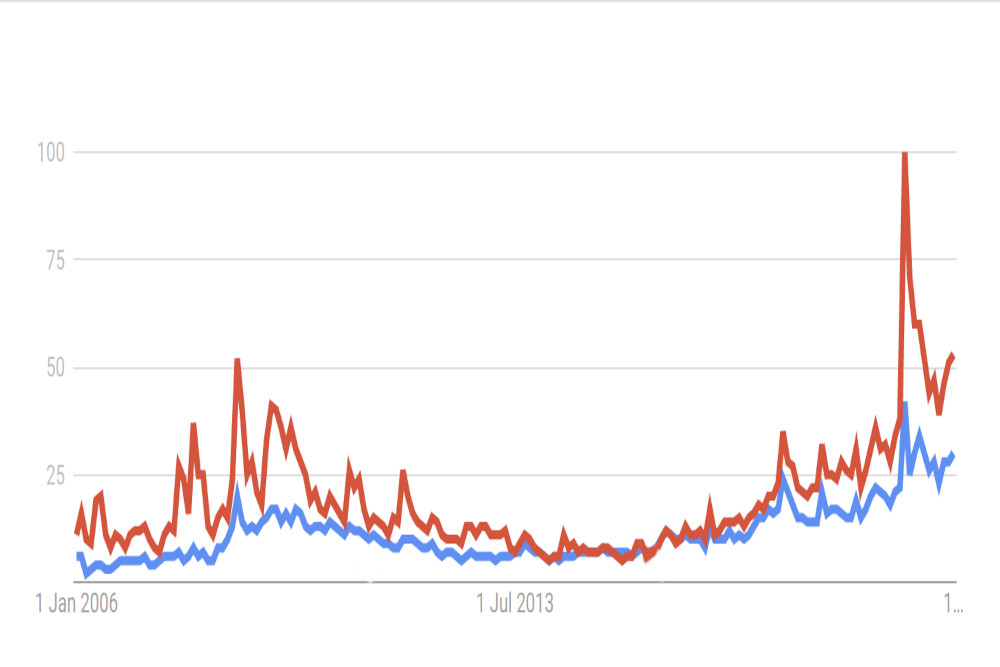

The unexpected "indicator" that caught the October 2008 and March 2020 major market bottoms

Besides price and fundamental data, there is a treasure trove of quantitative information about investor psychology that can be used for trading. We cover this in Course & Anticourse.

-

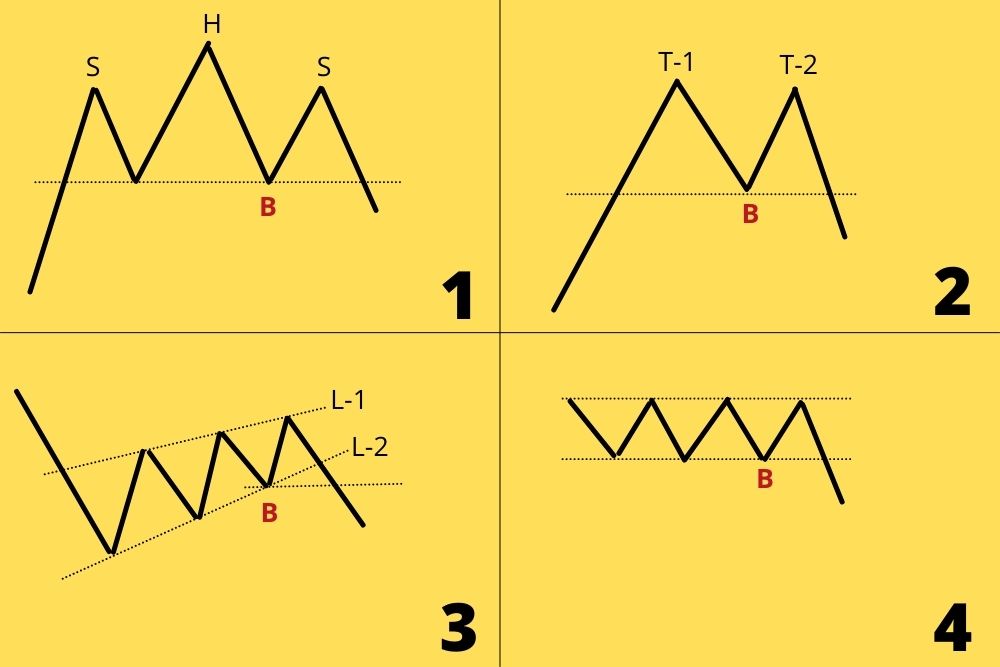

Technical Analysis : You need just one chart pattern!

Technical Analysis provides several chart patterns. These are largely redundant.

More Blog Posts

LATEST NEWS POSTS

-

PAGE UPDATES SOON!

All the pages with market statistics will be back once updated.

-

Argument is sometimes futile, and how to win one

You have no chance convincing people who have a deep-rooted belief in something - even though facts and logic show that they are completely wrong. At the same time, we do need to argue to make our case on several occasions, and neuroscience and psychology provide some useful tactics to get one's point across.

-

Just how many options actually expire worthless?

We examine how options finished at the end of each monthly expiry from August 2021 onward.

More News

LATEST CHAT POSTS

-

Option Symposium 4.0 Quantsapp's annual Conference on Options Trading aims to bring together the country's top Option Fund Managers, Derivative Analysts, Option Trainers & Individual Option Traders to join hands & enlighten option enthusiasts with various Practical Options Trading styles and their winning strategies. To Book Ticket Visit us @ https://www.quantsapp.com/learn/optionsymposium-4.0