TRADING & INVESTING STRATEGIES

Online Course

REGISTER NOW

Will a portfolio of the top 15 nifty gainers in the last twelve months beat the nifty in the next twelve?

Posted: Dec 20, 2021 13:16

SHARE

Will a portfolio built by picking the top 15 nifty stocks of a twelve-month period outperform the nifty in the next twelve months? We investigate whether it has been so for five successive years up to Dec 17, 2021.

In four of the five years, these portfolios easily outperformed the nifty. The exception was 2017-18, when the nifty finished ahead by just 1.31%. (These portfolios start with an equal investment in each stock).

While this may seem like an interesting what if exercise with surprising results, it is actually not so. The basis of this exercise is Momentum Investing, and the results are consistent with several academic studies on the subject.

Momentum (long only) investing involves buying stocks with high returns over the past 3-12 months.

The holding period for such porfolios is also typically 3-12 months. Momentum strategies could also include switching stocks, or using other performance measures.

You can learn Momentum Investing with all its variations in our online course:

Online Course: Trading and Investing Strategies

As a course participant you also get to build and monitor your own momentum portfolios for the US and Indian markets, and you will usually beat the benchmark indices comfortably. You also get to keep Google Sheets which perform these computations after the course as well. Momentum Investing is just one of several proven strategies you will learn in the course.

Picking the top 15 nifty performers is not an optimal momentum portfolio, though. This is because the choice is limited to just 50 stocks. Normally one would pick stocks from all liquid traded stocks.

Note that momentum investing has nothing to do with the momentum indicator used in Technical Analysis!

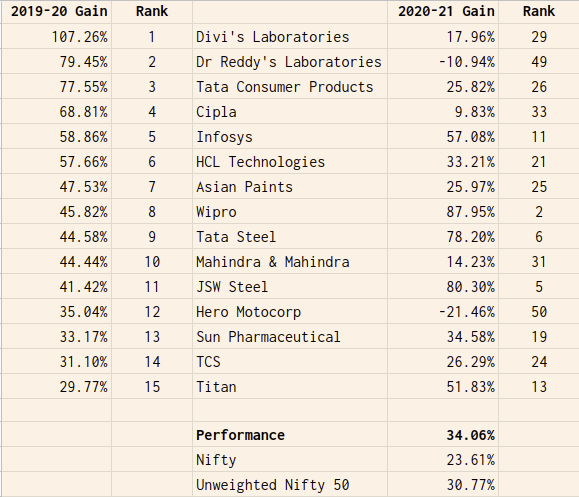

2020-21

The two columns on the left show the percentage gain and rank (1 to 15) of the top 15 nifty performers between Dec 18, 2019 and Dec 17, 2020. The two columns on the right do the same between Dec 18, 2020 and Dec 17, 2021.

The 15 stock portfolio gained 34.06% during the period, while the nifty gained 23.61%. Another statistic is provided - the average (unweighted) gain for the 50 nifty stocks, which stood at 30.77%.

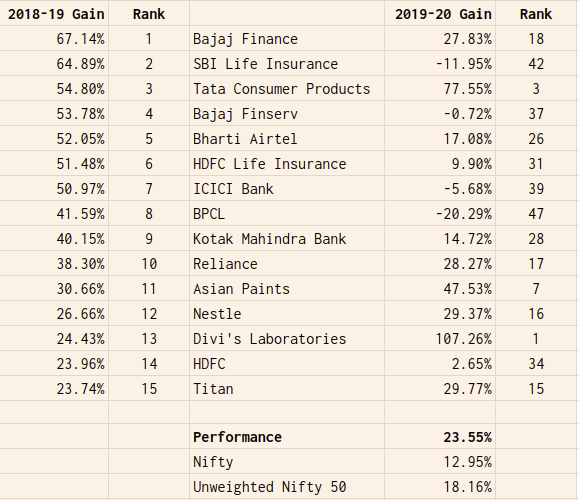

2019-20

The 15 stock portfolio gained 23.55% during the period, while the nifty gained 12.95%. The unweighted gain for the 50 nifty stocks was 18.16%.

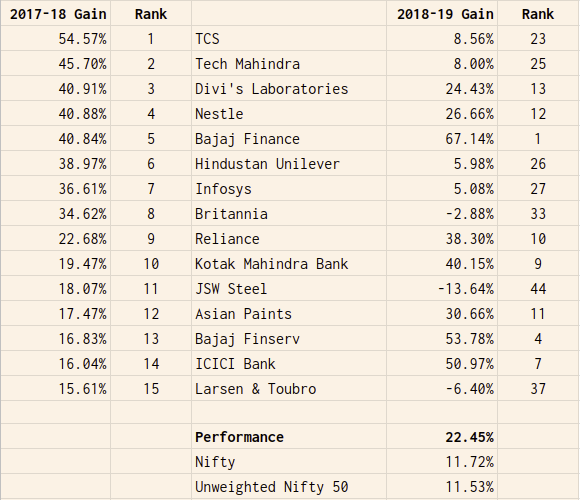

2018-19

The 15 stock portfolio gained 22.45% during the period, while the nifty gained 11.72%. The unweighted gain for the 50 nifty stocks was 11.53%.

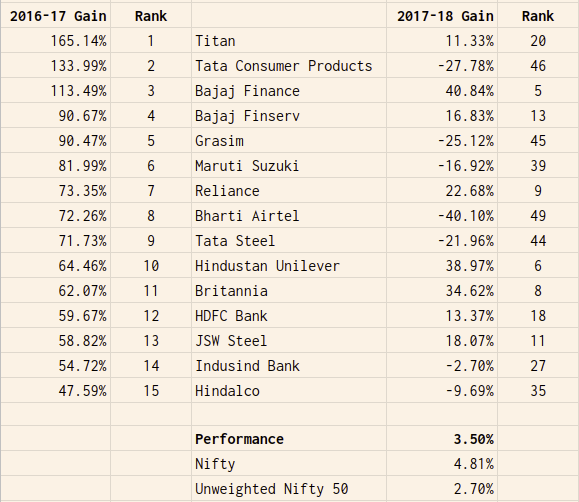

2017-18

The 15 stock portfolio gained 3.50% during the period, while the nifty gained 4.81%. The unweighted gain for the 50 nifty stocks was 2.70%. This is the only year among the five where the nifty finished ahead of the top 15.

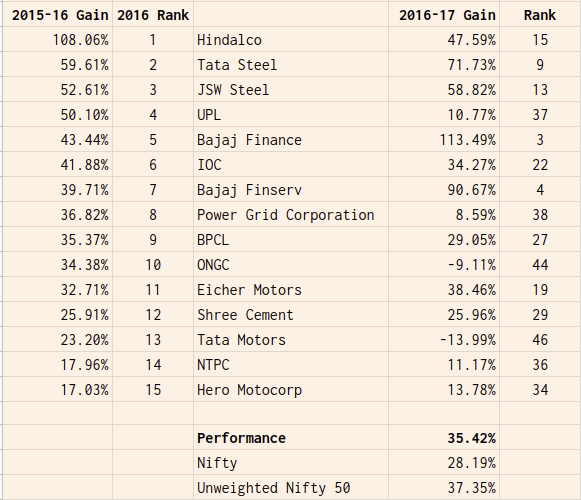

2016-17

The 15 stock portfolio gained 35.42% during the period, while the nifty gained 28.19%. The unweighted gain for the 50 nifty stocks was 37.35%, ahead of the top 15!

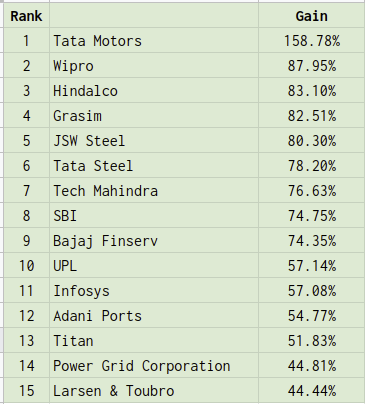

And finally, the answer to the question about which stocks are topping the nifty just now (December 17, 2021 closings).

2020-21 Top Gainers

More stories about:

Investing

Markets

Blog